Aircraft Values - Having suffered during the revaluation period since the pandemic, many 20-year-old aircraft now look set to hit a "value floor" where there is no further discount, Ishka's valuation team, which also warns that many of the younger models can. See more emphasis on values.

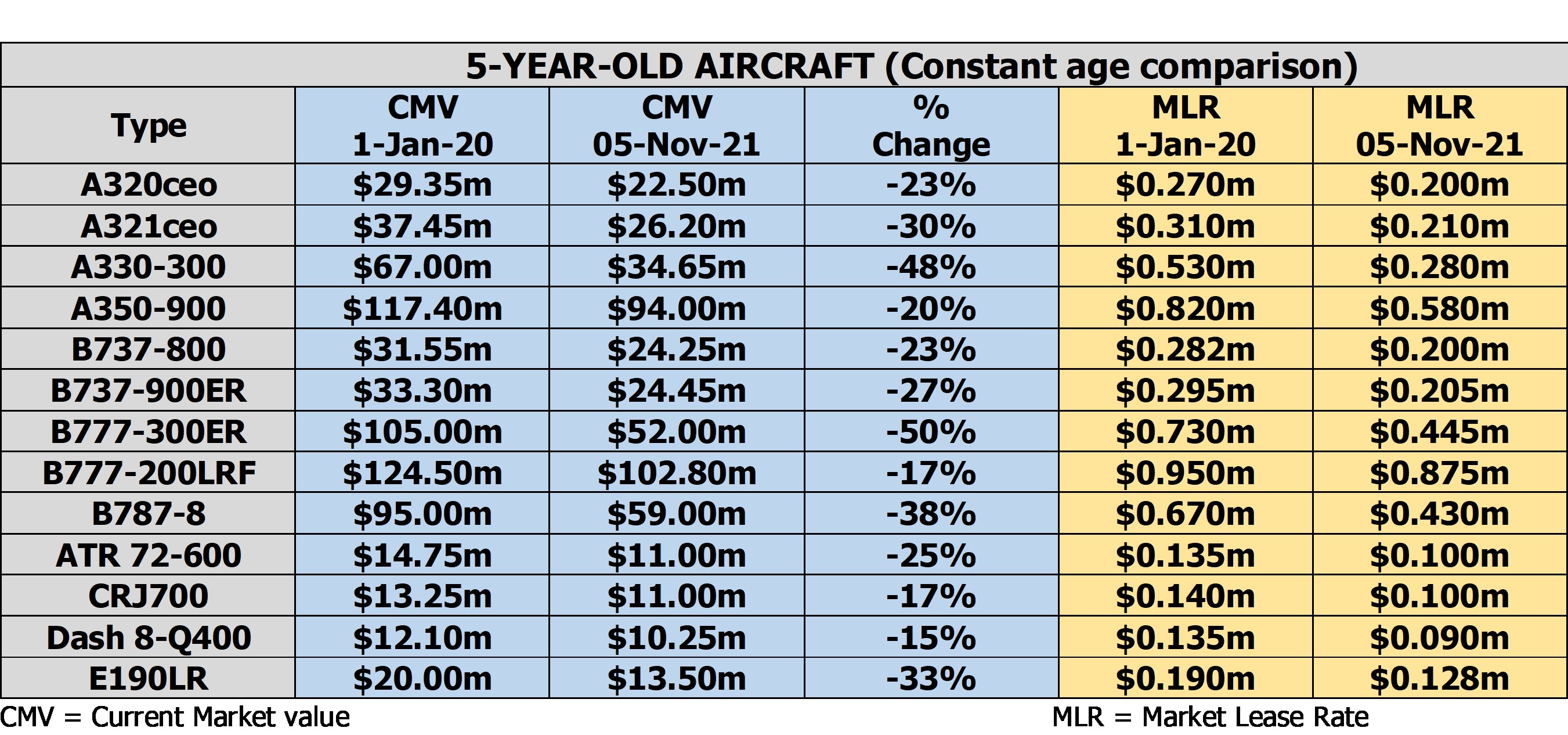

Since the beginning of the Covid-19 crisis, almost all types of aircraft have experienced a decrease in market value due to the widespread disruption of air traffic. According to Ishka's consulting division, older widebody aircraft have seen a drop in market value between 45% and 50%, while some of the more powerful narrowbody aircraft, such as the 737-800 and A320, have dropped between 15% and. 20% "On the other hand, young or newly built aircraft are now down about 10%-15% compared to January 2020 levels.

Aircraft Values

In recent months, the decline in market value for many types of aircraft has slowed (see chart below). Speaking to the Ishka Insights team, Eddy Pieniazek, Ishka's chief consultant, explained that the decrease in the decline is partly due to the significant decrease in value recorded at the beginning of the crisis, but added that some types of aircraft have reached a natural level. "floor."

Widebody Aircraft Values Update

"At a certain point there is a lower limit below which the value of some aircraft is not lower, this can be the exit value or the point where the investor simply does not want to trade the aircraft anymore," explained Pieniazek. "Especially with some of the younger aircraft, investors may prefer to hold the aircraft in inventory and wait for the market to pick up, rather than sell and lose." Value for disposal of aircraft engines and components. Some aircraft that are 20+ years old may already be in this class, but some aircraft still have a long way to go before they reach this class and so values can continue to decline with no sign of improving market demand.

Most aircraft stocks have seen some haircuts over the past 15 months. The strongest drop is in the two-sided aircraft. For example, since the beginning of the crisis, the value of the 2010 A330-300 has halved, falling from 47 million dollars in January 2020 to 22 million dollars in May 2021. Similarly, the value of the B777-300ER from 2010 has halved in the same period. The value of this type of aircraft dropped from $73 million to $34.5 million, according to Ishka's research. Many types of aircraft have experienced declines of between 30% and 40%.

The declining value observed by Ishka was echoed by other valuation experts who spoke at Ishka's London conference. Scope Ratings analyzed a sample of aircraft market value data over a 30-year period and found that aircraft values in a range covering almost all aircraft types have fallen by an average of 32% since the start of the Covid-19 pandemic. According to the same study, widebody scores decreased by an average of 44%. The asset class that performed best during the pandemic was transport aircraft, explained Helene Spro, director of Scope Ratings GmbH, and the aircraft class that performed the worst were large, wide-body aircraft such as the A380, A340 and B747. Spro emphasized that even with those widebody categories removed, the remaining widebody scores were still down an average of 39%.

However, the rapid erosion of the value at the beginning of the pandemic is followed by the next 'downward step', the spread of the disease has become a protracted event and is a recognition that the pace of market recovery will continue to disappoint in 2020 and in 2021 table. Below shows the current market value (CMV) and market rental rate (MLR) of narrowbody, widebody and regional aircraft from January 2020 to May 2021. Pieniazek emphasized that a 30% to 40% decrease in the market value of aircraft can tempt some. Speculative investors looking for an attractive entry point, hope for a market recovery soon but warn that the value of the aircraft is still vulnerable to further pressure.

The Sky Is The Limit: Perspectives On The Emerging European Commercial Aircraft Value Chain Recovery And Beyond

The driver behind the fundamental return of demand to the market is the speed of vaccination and the reduction of travel restrictions. As these continue to accelerate, there may be increased demand for travel, which may help drive a recovery in aircraft values for some asset classes. Pieniazek commented that the broad demand for narrow and regional aircraft is likely to result in a more balanced market in 2023 or 2024, while wide is unlikely to see that balance until 2024 or 2025. While some aircraft will show some recovery, others face the prospect of more permanent depreciation due to changes in the operational landscape and the flight route network.

The value of aircraft has taken a hit from the pandemic, however, some types of aircraft will recover faster than others. Reviewers believe that the smallest and most efficient planes are recovering the fastest and may exceed pre-Covid levels. Most reviewers believe that Neos, MAXs, B787s and A350s tend to be the best laid-back aircraft for leisure.

However, several new startups have been attracted to the A330 due to the availability of the aircraft and the attractive price (see Insight: "Will the use of A330s win the hearts (and wallets) of airline startups?"). Pieniazek noted that the A330s "could stimulate market demand" as some airlines are considering using widebody rather than narrowbody aircraft due to the current aircraft's price and versatility. However, he warned that generating demand for other widebody types such as the larger B777 would be more difficult.

Some older aircraft types will benefit when market stability returns and maintain their value. Other widebody aircraft types will struggle to find a home after the pandemic and values may struggle to recover as airlines aim to improve their fleets after the pandemic. Investors are in a "wait and see" mode regarding aircraft retirement. There is limited desire from investors to dispose of older aircraft in the current market while demand for spare parts is low, which has resulted in a large number of aircraft being held in limbo while investors decide the best course of action.

Duncan Aviation Values Quality & Continuous Improvement

Owners of current preserved aircraft face some difficult decisions. The options for these investors are to dispose of the aircraft at a lower lease rate, or to park the aircraft and pay for maintenance and storage, hoping to get a better lease rate in the future if and when demand returns. Indeed, the value of the fuselage of piston aircraft has increased more than both turboprops (+29 percent) and business jets (+24 percent). Many pilots know that the fleet's statistics are increasing, but do not know that this is happening at an unprecedented rate. This trend has many owners asking "Am I at financial risk in the event of an accident or storm damage?"

Like the housing market, many blue book aircraft do not achieve true market value. A good question to ask yourself is, "How much would it cost to replace my aircraft in today's market?" If you renew at the same rate every year, you may not have at least $100,000 of coverage. Assuming you haven't adjusted the hull since pre-Covid, here's what the average increase is:

While the value of all airplanes has increased in recent years, piston airplanes have seen the most notable changes. Since September 2019, the average fuselage value of piston aircraft has increased by 34 percent, a 5 percent increase compared to turboprops and 10 percent higher than business jets. While the value of all piston aircraft was affected, some manufacturers and models experienced significant price increases.

The change in value of turboprop aircraft is slightly lower compared to piston aircraft, but still increases significantly. Similar to piston aircraft, some makes and models have seen greater increases than others.

Atsg Eyes Falling A321 Values For Freighter Conversions

Because of these changes, there has been much discussion among owners and operators this year about increasing the fuselage value of their aircraft. It strikes me that many pilots and aircraft operators who have been in the industry for a long time mention the importance of aircraft insurance based on the current market value.

Another interesting trend supported by the data is the lead time for new deliveries from manufacturers such as Pilatus, Cirrus, Piper, Ursprung etc. Manufacturers at EAA Oshkosh 2022 confirmed that when buying a new business jet you may have a significant impact on the waiting time.

Of course, there is a chance that customers will cancel their orders, but these lead times indicate a significant number of orders and requirements, which have increased the value of the aircraft. Needless to say, the global pandemic and supply chain disruptions have had a major impact on the aircraft industry and pilots and owners have a lot to consider when insuring their aircraft.

In most cases, aircraft owners can request a fuselage valuation at what they believe to be the current market value by simply notifying their insurance broker. However, in some situations, underwriters will require additional reasons. This may include

Airliner Values Struggle To Rise Amid More Market Uncertainty

Redfin values, aircraft values free, aircraft values online, aircraft blue book values, aircraft market values, used aircraft values, capacitor values, free used aircraft values, iba aircraft values book, commercial aircraft values, free aircraft blue book values, aircraft values online free

0 Comments